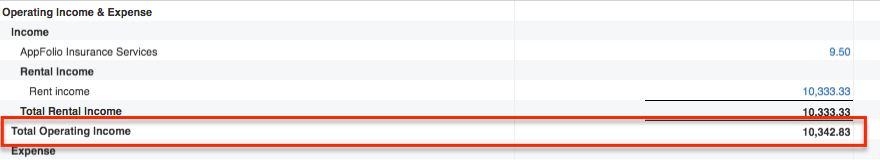

1099s report total gross income in the tax year per owner (not per property). Your 1099 is:

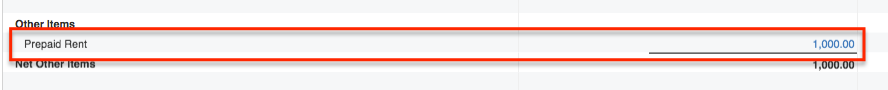

“Total Operating Income” PLUS net change in “Prepaid Rent”

The following images show the appropriate lines to reference on your cash flow report which has been e-mailed to you.

It is possible that the “Prepaid Rent” line would be a negative number. In this case, you received prepaid rent in the prior calendar year, but not the current year.

Why do we include prepaid rent? The IRS considers advance rent taxable income, even if the owner does not receive the prepaid funds until January. This is in accordance with IRS Publication 527 (Residential Rental Property) under “Advance rent” and IRS Publication 528 (Accounting Periods & Methods) under “Constructive receipt.” Your CPA may report your income differently on your actual tax return but we are following these standards for your 1099.

We frequently receive the question “I compiled my own income statement from the monthly owner packets. Why do PMC’s reports not match my own income statement?” If you are compiling your own income statement, it is unlikely that you’ll be able to match PMC’s reports for several reasons. The monthly owner statements only show money going in and out of your account, and does not include general ledger level details. For example, when we retain money from a tenant’s security deposit, the statement does not show how much was credited as rent income and how much was booked to an expense account. We strongly discourage owners from attempting to generate income statements off of owner packets and strongly encourage you to use the end of the year reports we send for your tax purposes.

Questions? Please e-mail your question to nashville@purepm.co so we can research your question.